Extra Mortgage Payment Principles

Should You Make Extra Mortgage Principal Payments? in Carrollton-Texas

On the flip side, you could go for another 30-year term to reduce your regular monthly payments. Nevertheless, loans with shorter terms tend to have lower interest rates, allowing you to both save on interest and reach full ownership much earlier. In some cases, however, refinancing could cost you more in the long run, particularly if you’re planning to extend your loan term.

Do not forget closing costs either. If your lending institution consents to let you roll those expenses into your loan, you could wind up paying more cash. After all, you’ll now be on the hook for interest on a larger loan quantity. Whether you need to settle your mortgage early ultimately depends upon just how much money you have to spare, what your options are, and other elements that are distinct to you.

If you’re ready to discover an advisor who can assist you achieve your monetary goals, start now. Securing a home mortgage can be a stressful and confusing procedure. For starters, you require to find out what term is best for you, whether you want a repaired or variable rate of interest, and where to get the best mortgage rates.

Mortgage Early Pay Off Calculator – Free & Easy To Use in Lowell-Massachusetts

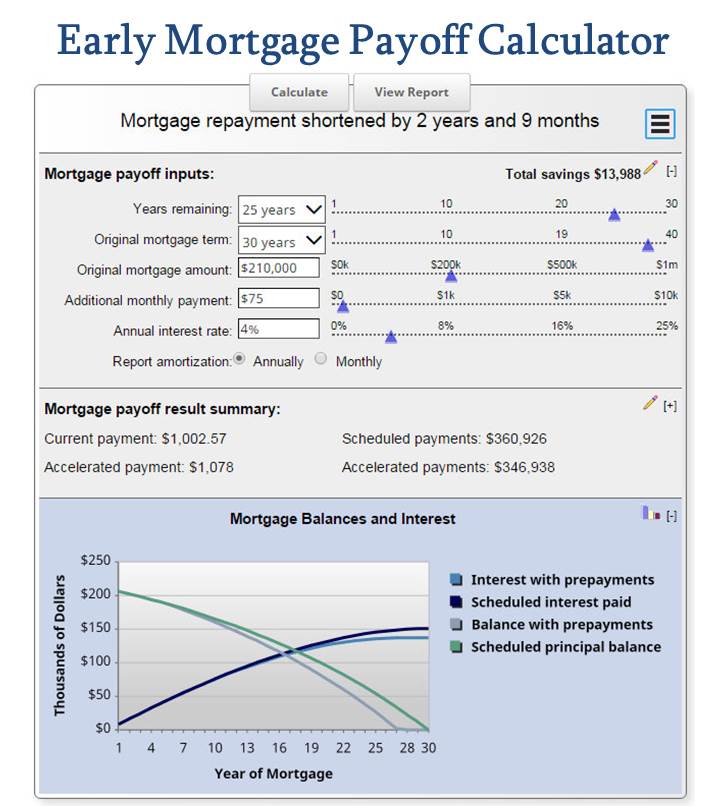

How do I pay off my mortgage early? One method to settle your home loan early is by including an extra amount to your regular monthly payments. eLearning Course How Money Works””>Payoff Mortgage Fast. However, just how much more should you pay? Nerd, Wallet’s early home loan reward calculator figures it out for you (pay off mortgage 10 years). Complete the blanks with information about your home mortgage, then get in the number of more years you want to pay it.

What the early home mortgage payoff calculator does, Do you want to settle your home loan early? Possibly you have 27 years staying on your home mortgage but you would rather pay it off in 18 years instead. The early reward calculator shows how to reach your objective. The mortgage reward calculator reveals you: How much more primary you would need to pay each month so you can pay off the loan in a specific number of years.

There are lots of factors you may desire to accelerate the home mortgage’s payoff, however, the inspiration normally comes down to either or both of these: You desire to own your house free and clear by a turning point in life, such as your retirement or the beginning or end of your kids’ college years.

Should You Pay Off Your Mortgage Early? – Money Helper in Lakewood-Colorado

How to use the early mortgage payoff calculator To complete the calculator’s boxes properly, seek advice from a current monthly statement or the very first page of the Closing Disclosure that you received when you closed on your home loan. Under Loan term (in years), go into the variety of years for which your house is financed.

Under Interest rate, get in the percentage. Under How many years are left on your home mortgage? Under In how many years do you want to pay off your home loan?

Or you can utilize Nerd, Wallet’s mortgage amortization calculator and drag the slider to find out just how much you still owe. What the mortgage benefit calculator tells you, The Summary Results section has two subheadings: How to reach your objective describes how much you would have to pay in primary and interest each month to satisfy the payoff goal.

When Should You Pay Off Your Mortgage Early? – The Motley … in Honolulu-Hawaii

Loan comparison summary explains the total cost of the home loan in principal and interest payments, the original regular monthly principal-and-interest payment, the total expense in principal and interest if you pay it off early, and the new month-to-month principal-and-interest payment to reach your reward objective.” New month-to-month P&I” and “Original month-to-month P&I” comprise only the principal and interest parts of your month-to-month payments.

If you can refinance to a lower interest rate, for a much shorter term, it’s a win-win. For example, you could re-finance a 30-year home mortgage into a 15-year loan. The month-to-month payments will likely be greater, and you’ll pay closing costs, however, your total interest cost will be significantly lower.

Want to pay off your home loan quicker than 30 years? There are numerous good ways to pay off your mortgage faster and save big on interest payments (eLearning Course How Money Works””>Payoff Mortgage Fast).

Should I Pay Off My Mortgage Early? – The Washington Post in Lowell-Massachusetts

If you have additional money to spend on your mortgage, it might generate more worth elsewhere. Few individuals keep a 30-year loan for its full term.

But what about property owners who sit tight for the long run? Those thirty years of interest payments can start to feel like a concern, especially compared to the payments on today’s lower interest rate loans. You might find yourself questioning how to pay your home loan off faster so you can live debt-free and have full ownership of your home.

There are a number of ways to reduce your loan term and save a ton of money in interest on your home loan. Refinance to a shorter term The 30-year house loan is most popular, but loan providers offer much shorter loan terms, too.

Pitfalls Of Paying Off Your Mortgage Early – Abc News in Roseville-California

625%, your regular monthly payment would be $1,450 You’d pay a few hundred more per month, however, you would be mortgage-free a decade faster The very best part? The savings in interest on that 20-year mortgage would be over $65,000 if you kept the loan till it was paid off. Another benefit of refinancing to a shorter-term is that you do not have to start over with 30 more years. Pay off mortgage faster calculator.