alex

How To Refinance A Home Mortgage – The Ultimate Guide

Refinancing a home mortgage can be a smart move for homeowners looking to lower their monthly payments, reduce their interest rates, or tap into their home’s equity. But the refinancing process can seem overwhelming, with numerous factors to consider and decisions to make. This ultimate guide will provide you with all the information you need to understand how to refinance a home mortgage successfully.

Understanding Home Mortgage Refinancing

Refinancing a home mortgage involves replacing an existing mortgage with a new loan. The new loan typically comes with different terms, such as a lower interest rate, shorter loan term, or access to equity. The refinancing process can help homeowners save money, reduce monthly payments, or pay off their mortgage sooner.

There are several reasons why homeowners may consider refinancing their mortgage. Some homeowners refinance to obtain a lower interest rate, which can significantly reduce monthly payments and save money over the life of the loan. Others may choose to refinance to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, providing more stability and predictability in monthly payments. Homeowners may also refinance to access equity in their home, which can be used for home improvements, debt consolidation, or other financial goals.

Tip: Before refinancing, it’s important to assess your financial situation, including your credit score, debt-to-income ratio, and home equity. This will help determine whether refinancing is a viable option and what terms and rates you may be eligible for.

| Refinancing Process: | Factors to Consider: |

|---|---|

| 1. Assess your financial situation | • Credit score • Debt-to-income ratio • Home equity |

| 2. Gather required documentation | • Mortgage statements • Income documents (pay stubs, tax returns) • Bank statements • Property appraisal reports |

| 3. Find the right lender | • Mortgage lenders (banks, credit unions, online lenders) • Loan officers • Comparison shopping |

| 4. Calculate refinance costs and potential savings | • Refinance costs (closing costs, fees) • Annual percentage rate (APR) • Interest savings • Break-even point |

| 5. Apply for a refinance loan | • Loan application • Pre-approval • Loan estimate • Underwriting process • Lock-in period |

| 6. Close the refinance loan | • Loan closing • Signing documents • Funding • Cancellation period • Post-closing responsibilities |

The refinancing process involves several steps, including assessing your financial situation, gathering required documentation, finding the right lender, calculating potential savings, applying for a refinance loan, and closing the loan.

Understanding Home Mortgage Refinancing Options

There are several refinancing options available to homeowners, including rate-and-term refinancing, cash-out refinancing, and streamline refinancing.

- Rate-and-term refinancing: This option involves refinancing to obtain a lower interest rate or a shorter loan term. This can help reduce monthly payments, save money over the life of the loan, or pay off the loan sooner.

- Cash-out refinancing: This option allows homeowners to access equity in their home by refinancing for a higher loan amount than their existing mortgage. Homeowners can use the cash to pay for home improvements, debt consolidation, or other financial goals.

- Streamline refinancing: This option is available for homeowners with government-backed loans, such as FHA or VA loans. Streamline refinancing typically involves minimal paperwork and can provide a simpler and faster refinancing process.

Tip: Before choosing a refinancing option, it’s important to assess your financial goals and determine which option aligns best with your needs.

“Refinancing can offer significant benefits for homeowners, including lower interest rates, reduced monthly payments, and access to equity. By understanding the refinancing process and assessing your financial situation, you can make an informed decision and secure the best terms and rates.”

Assessing Your Financial Situation

Before proceeding with a mortgage refinance, it is important to assess your financial situation to determine if it is the right move for you. Here are some key factors to consider:

| Financial Factor | What to Consider |

|---|---|

| Credit Score | A high credit score can potentially help you get a better interest rate on your refinance loan. Check your score and take steps to improve it if necessary. |

| Debt-to-Income Ratio | This ratio compares your debt payments to your income. A lower ratio can make you a more attractive candidate for refinancing. |

| Home Equity | If you have built up significant equity in your home, you may be able to access it through a cash-out refinance. Consider how much equity you have and how you plan to use it. |

Note: If your credit score or debt-to-income ratio needs improvement, take the time to work on those factors before applying for a refinance loan. This may give you a better chance of being approved, as well as better loan terms and rates.

Once you have assessed your financial situation, you can determine if a mortgage refinance is the right choice for you. Keep in mind that there may be costs associated with refinancing, such as closing costs and fees, so make sure to factor those into your decision.

Gathering Required Documentation

Before starting the mortgage refinance process, you’ll need to gather the necessary documents to ensure a smooth application process. Here’s a list of essential documents you’ll need:

| Document | Description |

|---|---|

| Mortgage Statements | Provide copies of your current mortgage statements. |

| Income Documents | Include recent pay stubs, W2 forms, and tax returns for the past two years. |

| Bank Statements | Provide copies of your bank statements for the past two to three months. |

| Property Appraisal Report | Depending on the lender’s requirements, you may need to provide a recent property appraisal report. |

Keep in mind that different lenders may have varying documentation requirements. It’s essential to confirm with your lender the specific documents that they need before starting the application process. Also, ensure that all the documents you provide are accurate and up-to-date.

Finding the Right Lender

Finding the right lender is critical to securing the best terms and rates for your mortgage refinance. There are different types of lenders available, including:

- Mortgage companies

- Local banks

- Online lenders

It’s essential to compare offers from different lenders and research their background to ensure credibility and legitimacy. Here are some tips for finding the right lender:

- Check for recommendations from friends, family, or real estate agents.

- Shop around for different loan offers and compare them based on interest rates, fees, and terms.

- Read online reviews from reputable sources and check the lender’s rating with the Better Business Bureau.

- Consider working with a loan officer who can help guide you through the process and answer any questions you may have.

Calculating Refinance Costs and Potential Savings

Refinancing a mortgage can come with a variety of costs, so it’s important to understand these expenses to determine if refinancing is worth it for you. The costs associated with refinancing typically include closing costs, which can range from 2% to 6% of the loan amount. Other fees may include an appraisal fee, title search and insurance, and application fees.

One way to compare different loan offers is to calculate the annual percentage rate (APR). The APR takes into account not only the interest rate but also the closing costs and any other fees. By comparing the APR of different loan offers, you can get a more accurate picture of the total cost of each loan.

| Refinance Costs to Consider | Explanation |

|---|---|

| Closing Costs | Typically 2% to 6% of the loan amount, covers expenses such as appraisal, title search, application fees, points and prepaid interest. |

| Annual Percentage Rate (APR) | The annual cost of a loan, including fees and interest, expressed as a percentage. |

| Interest Savings | The amount you could save in interest over the life of the loan. Use a refinance mortgage rates calculator to estimate this amount. |

| Break-Even Point | The point where you’ve recouped the cost of refinancing. This is calculated by dividing the total closing costs by the monthly savings achieved from refinancing. For example, if the cost to refinance is $3,000 and you save $100 per month, it will take 30 months to break even. |

Another cost to keep in mind is the potential penalty for paying off your existing mortgage early, which is typically a percentage of the remaining balance. Check with your current lender to find out if there are any prepayment penalties for refinancing.

While refinancing can come with upfront costs, it can also lead to long-term savings by lowering your interest rate and monthly mortgage payments. To determine if refinancing is worth it for you, consider the total cost of the loan, the potential savings in interest, and your break-even point. Use an online refinance mortgage rates calculator to estimate your potential savings and compare different loan offers.

Applying for a Refinance Loan

Once you have decided on a lender and a refinance option, it’s time to apply for the loan. The application process is similar to applying for your original mortgage, with a few differences. Below are the key steps to follow:

- Submit your loan application: Fill out the loan application thoroughly and accurately, providing all the necessary information and supporting documents.

- Obtain pre-approval: Your lender will evaluate your application and determine if you meet their requirements for a refinance loan. If approved, you will receive a pre-approval letter.

- Receive a loan estimate: Your lender will provide a loan estimate that breaks down the loan terms and costs in detail. Review it carefully to ensure accuracy and compare it with other lender’s estimates.

- Begin the underwriting process: Your lender will review your application and documentation to verify your income, assets, and creditworthiness. Be prepared to respond promptly to any additional requests for information or documentation.

- Lock in your interest rate: Once you have received final loan approval, you can lock in your interest rate to avoid any potential rate increases during the closing period. Be sure to confirm the lock-in period and understand any associated fees.

It’s important to stay in close communication with your lender throughout the application and approval process to ensure a smooth and timely closing. Respond quickly to any requests for additional information, provide accurate information on your application, and review all loan documents carefully before signing.

Closing the Refinance Loan

After completing the underwriting process and receiving final approval for a refinance loan, the closing process begins. This is the final step before the new loan replaces the existing mortgage.

During the closing, borrowers are required to sign several documents, including the loan application, promissory note, and closing disclosure. It is crucial to review these documents carefully to ensure that the loan terms and conditions match the original agreement and that there are no errors or discrepancies.

Borrowers are also required to provide any necessary funds, such as a down payment or closing costs, at the closing. It is essential to have these funds readily available and in the form required by the lender, such as a cashier’s check or wire transfer.

Once all the paperwork is signed and the funds are provided, the new loan is funded, and the existing mortgage is paid off. The cancellation period begins from this point, during which borrowers have three days to cancel the loan if they change their mind. This period may vary depending on state and lender regulations.

After the cancellation period ends, borrowers are responsible for making their loan payments according to the agreed-upon terms and conditions. It is essential to continue making payments on time and review the loan statements regularly to ensure that they align with the original agreement.

Section 9: Frequently Asked Questions (FAQ) about Mortgage Refinancing

FAQ 1: Is refinancing worth it?

Refinancing can be a great way to save money on your mortgage payments or access equity in your home. However, it’s important to consider the costs of refinancing and compare them to the potential savings. In some cases, refinancing may not be worth it, particularly if you plan to sell your home in the near future. Speak to a mortgage professional to determine if refinancing is a good option for you.

FAQ 2: What happens to my existing mortgage when I refinance?

When you refinance your mortgage, your existing loan is paid off in full, and a new loan is issued in its place. This means that your original mortgage is essentially replaced with a new one, with different terms, rates, and conditions. You’ll need to pay off any remaining balance on your original mortgage and start making payments on the new loan.

FAQ 3: What are the typical closing costs for a refinance loan?

Closing costs for a refinance loan can vary depending on the lender and the type of loan. However, they typically include fees for loan origination, appraisal, credit check, title search, and other miscellaneous costs. Closing costs can add up to several thousand dollars, so it’s important to factor them into your decision when considering a refinance.

FAQ 4: What is a loan estimate, and why is it important?

A loan estimate is a document that outlines the terms and estimated costs of a mortgage refinance loan. It’s provided by the lender after you apply for the loan and typically includes details on the interest rate, monthly payments, closing costs, and other fees. The loan estimate can help you compare different loan offers and make an informed decision about the best option for your situation.

FAQ 5: What is the underwriting process, and how long does it take?

The underwriting process is the stage where the lender reviews your application, credit history, income, and other financial information to determine your eligibility for a refinance loan. The process typically takes several weeks, although it can be expedited if you provide all the necessary documentation and respond to any requests from the lender promptly.

FAQ 6: What is a lock-in period, and how does it affect my loan?

A lock-in period is a period of time during which the lender guarantees a particular interest rate for your refinance loan. This means that even if interest rates rise during the lock-in period, you’ll still be able to get the rate that was agreed upon when you applied for the loan. Lock-in periods can vary depending on the lender and the type of loan, so be sure to ask about them when considering a refinance.

Related Posts

Can Mortgage Interest Be Deducted

Mortgage Interest Deduction Can Be Complicated. – An Overview

So the question is, can mortgage interest be deducted. If you’re a homeowner, you possibly get a reduction on your home mortgage interest. The tax obligation reduction additionally applies if you pay interest on a condo, cooperative, mobile house, watercraft or mobile home utilized as a house – can mortgage interest be deducted. It pays to take home loan passion reductions If you itemize, you can typically deduct the rate of interest you pay on a home loan for your main house or a second house, however, there are some limitations.

For tax years prior to 2018, the maximum amount of debt eligible for the reduction was $1 million. Starting in 2018, the maximum amount of financial debt is limited to $750,000. Mortgages that existed as of December 14, 2017 will certainly remain to receive the same tax treatment as under the old guidelines.

These lendings include: A mortgage to get your house, A bank loan, A line of credit rating or A house equity car loan.

If the financing is not a safeguarded financial obligation on your residence, it is thought about an individual funding, and also the rate of interest you pay usually isn’t insurance deductible. Your home mortgage must be secured by your main house or a 2nd house.

Is my home a residence? For the internal revenue service, a home can be a home, condo, cooperative, mobile residence, watercraft, RV, or similar home that has sleeping, cooking as well as toilet centers. That obtains to take the deduction? You do, if you are the key borrower, you are legitimately obliged to pay the financial debt as well as you in fact make the payments (can mortgage interest be deducted).

Getting My Mortgage Interest Deduction: What Qualifies In 2022 To Work

Mortgages that existed as of December 14, 2017 will certainly remain to get the very same tax therapy as under the old guidelines. For tax years prior to 2018, you can additionally typically subtract passion on home equity financial obligation of up to $100,000 ($50,000 if you’re wed as well as file independently) despite how you use the finance proceeds.

What if my circumstance is special? Right here are a few unique circumstances, you might experience. If you have a 2nd residence that you rent out for part of the year, you should utilize it for more than 2 weeks or greater than 10 percent of the variance of days you rented it out at a reasonable market price (whichever number of days is bigger) for the home to be taken into consideration a second home for tax objectives.

You might deal with a various house as your second residence each tax year, given each home satisfies the qualifications kept in mind. If you reside in a residence before your purchase ends up being last, any payments you create that amount of time are thought about the lease. You cannot deduct those payments as interest, even if the negotiation papers classify them as rate of interest.

The rate of interest is attributed to the activity for which the financing earnings were made use of. If you own rental residential or commercial property and obtain versus it to purchase a home, the interest does not certify as home loan passion since the financing is not protected by the home itself. Interest paid on that particular financing can not be deducted as a rental expense either, due to the fact that the funds were not made use of for the rental residential or commercial property.

Facts About Mortgage Interest Deduction: What Qualifies In 2022 Uncovered

Starting in 2018, the passion on residence equity debt is no more insurance deductible unless it was use to purchase, develop, or significantly improve your house. If a home loan does not fulfill these requirements, your rate of interest deduction might be restricted. To determine just how much passion you can deduct as well as for even more information on the regulations summarized above, see IRS Magazine 936: Home Home Mortgage Passion Reduction.

The extra over the old mortgage balance not used to get, construct, or significantly improve your home may certify as home equity debt. For tax years prior to 2018, interest on approximately $100,000 of that excess financial obligation may be deductible under the guidelines for house equity financial obligation. Likewise, you can deduct the factors you pay to get the new loan over the life of the car loan, presuming every one of the new loan equilibrium qualifies as acquisition.

In the year you settle the loan because you offer your home or re-finance again you reach deduct all the points not yet deducted, unless you re-finance with the exact same lending institution. In that instance, you include the factors paid on the most up-to-date offer to the leftovers from the previous refinancing as well as deduct the expense on a pro-rated basis over the life of the new lending.

These consist of: Copies of Type 1098: Mortgage Interest Declaration. Form 1098 is the statement your lending institution sends you to allow you recognize just how much mortgage passion you paid throughout the year as well as, if you bought your residence in the existing year, any type of deductible points you paid. Your closing statement from a refinancing that shows the points you paid, if any, to re-finance the car loan on your property.

A Biased View of Mortgage Interest Deduction: What Qualifies In 2022

Component I. House Home Loan Interest This component describes what you can deduct as house mortgage passion. It consists of conversations on factors, home mortgage insurance premiums, and also exactly how to report deductible passion on your tax obligation return. Typically, home mortgage passion is any kind of rate of interest you pay on a loan protected by your house (main residence or a second residence).

You can’t deduct house mortgage rate of interest unless the list below problems are met. You submit Form 1040 or 1040-SR and also detail deductions on Schedule A (Form 1040). The home mortgage is a protected financial obligation on a certified home in which you have an ownership rate of interest. Safe Financial obligation and also Qualified Home are discussed later on.

Keep in mind. Rate of interest on house equity financings and also lines of credit rating are deductible only if the borrowed funds are utilized to get, construct, or substantially improve the taxpayer’s home that secures the loan. The funding needs to be protected by the taxpayer’s major home or second residence (qualified home), and also meet other needs. deducting interest on mortgage.

Just how much you can deduct depends upon the day of the home loan, the amount of the home mortgage, as well as just how you make use of the home loan earnings. If every one of your mortgages suit several of the adhering to 3 categories whatsoever times during the year, you can deduct every one of the rate of interest on those home loans.

A Guide To Mortgage Interest Deduction – The Facts

Do you meet the conditions (Afterthought 1) to deduct house mortgage interest? Footnote 1: You should make a list of deductions on time A (Kind 1040). The car loan should be a safeguarded financial obligation on a qualified house. See Part I, House Mortgage Rate of interest, earlier. If no, you can’t deduct the passion payments as residence mortgage rate of interest (Explanation 2) – mortgage interest.

Stop here If indeed, continue to Decision (2) Were all of your home mortgages taken out on or before October 13, 1987? If indeed, your house mortgage passion is completely insurance deductible. You do not need to review component II of this publication. Stop here. If no, continue to Decision (3) Were every one of your residence mortgages taken out after October 13, 1987, made use of to purchase, build or considerably enhance the primary house protected by that main residence mortgage or made use of to buy, build or improve the 2nd residence protected by that 2nd house mortgage, or both? If no, go to component II of this publication to determine the limitations on your deductible house mortgage interest.

For more helpful information on your home mortgage or refinancing, visit our main page by clicking here.

Mobile Home Financing

Facts About Hud Financing Manufactured (Mobile) Homes Uncovered

This can be a great choice for an affordable smaller home however you should know about mobile home financing before you begin your search. A double wide mobile home is a prefabricated home that is typically at least 20 feet wide and no more than 90 feet long. Modular homes are very similar to stick built homes, but they are prefabricated in a factory or other offsite facility, and then transported in one or more sections to the home site and finished in place.

Affordable Real Estate Solutions For those who want affordable real estate, a mobile home can be a great option (mobile home financing). With more and more people leaning toward a simpler lifestyle, manufactured homes can provide efficient living arrangements. If you’re in the market for a mobile home and need help with financing, you’ll be glad to know that e, LEND offers mobile home loans as well as mobile home loan refinancing.

See This Report about Hud Financing Manufactured (Mobile) Homes

The home must have been built after June 15, 1976, and in conformance with the Federal Manufactured Home Construction and Safety Standards (there will be a certification label to signify this). The home must be on a permanent foundation and cannot be located in a mobile home park. The loan must also cover the land that the manufactured home sits on.

Title I manufactured home loans are not Federal Government loans or grants (mobile home financing with land). The interest rate, which is negotiated between the borrower and the lender, is required to be fixed for the entire term of the loan, which is generally 20 years. A Title I loan may be used for the purchase or refinancing of a manufactured home, a developed lot on which to place a manufactured home, or a manufactured home and lot in combination.

Manufactured Home Loans – Truths

For Title I insured loans, borrowers are not required to purchase or own the land on which their manufactured home is placed. Instead borrowers may lease a lot, such as a site lot within a manufactured home community or mobile home park (mobile home financing companies). When the land/lot is leased, HUD requires the lessor to provide the manufactured homeowner with an initial lease term of 3 years.

These retailers are listed in the yellow pages of your telephone directory. They have the required application forms. Manufactured homes must comply with the Model Manufactured Home Installation Standards, and all applicable state and local requirements governing the installation and construction of the manufactured home foundation system. HUD provides two types of consumer protection.

Fascination About Mobile Home Loans & Mortgage Financing

After moving in, the borrower can call HUD at (800) 927-2891 to get assistance about the problems with construction of the home. Have sufficient funds to make the minimum required downpayment. Be able to demonstrate that they have adequate income to make the payments on the loan and meet their other expenses.

Have a suitable site on which to place the manufactured home. The home may be placed on a rental site in manufactured home park, provided the park and lease agreement meet FHA guidelines. The home may be situated on an individual homesite owned or leased by the borrower. Meet the Model Manufactured Home Installation Standards (mobile home financing companies).

Examine This Report about Mobile Home Loans & Financing

Lenders may not deny funds or offer less favorable terms and conditions in lending on the basis of the borrower’s race, color, religion, sex, national origin, familial status (i. e., the presence or number of children in a household) or disability. In addition, lending decisions may not be based on the race, color, sex, religion, national origin, familial status or disabilities of persons associated with the borrower or with the area surrounding the property.

While most traditional lenders won’t give you a mortgage to buy one, there are other options available. What are the differences between mobile, modular and manufactured homes? You’ll often hear the terms mobile, manufactured and modular when discussing these similar types of homes. While they are related, there are some important differences between these homes.

The Best Strategy To Use For Mobile And Manufactured Home Loans

It may or may not use metal tie-downs in place of a traditional foundation. However, this explanation can actually apply to manufactured homes as well. Whether a house is considered to be a mobile home depends on when it was made. Homes built in a factory before June 15, 1976, are known as mobile homes.

Department of Housing and Urban Development (HUD) enacted the National Manufactured Housing Construction and Safety Standards Act. After that date, new safety standards went into effect, which led to a new designation for these types of homes. Manufactured home, Like mobile homes, manufactured homes are built in a factory. They can be set up at their permanent location on blocks, metal piers or a permanent foundation.

The 5-Second Trick For Hud Financing Manufactured (Mobile) Homes

According to the Housing Act of 1980, factory-built homes constructed on or after June 15, 1976, are considered manufactured homes. The construction of these homes is highly regulated by HUD under the Manufactured Home Construction and Safety Standards (HUD Code). Additionally, these types of homes must meet local building standards for the communities where they will be located.

Modular homes, Like mobile and manufactured homes, modular homes are built in a factory and shipped to the land where they will be set up – mobile home financing with land. However, modular homes are more similar to traditional homes. They often include crawlspaces and basements and use a traditional foundation. Modular homes can also be delivered in two or more modules that are then put together on site in the desired arrangement.

See This Report on Mobile Home Loans & Mortgage Financing

A local contractor typically manages the process of joining these multiple pieces together to complete the construction of the home. Modular homes must be constructed to the same state, local or regional building codes as site-built homes – mobile home financing companies.: Before you start shopping, understand the difference between a mobile, modular and manufactured home.

Other requirements for the home include: Have a minimum floor area of 400 square feet or greater. Be constructed after June 15, 1976. Must be classified as real estate but not necessarily for state tax purposes. Must be built and remain on a permanent chassis. The loan must cover the home and the land on which it stands.

The Main Principles Of Manufactured Home Mortgage

The loans come with 30-year financing, and you may be able to secure them with a down payment as low as 3 percent. As an added benefit, interest rates on MH Advantage mortgages tend to be lower than those of most traditional loans for manufactured homes. Freddie Mac, You may be able to obtain conventional financing for a manufactured home through the Freddie Mac Home Possible mortgage program.

You may be able to secure a loan with as little as 3 percent down and, in some cases, use gifted or grant money to help cover your down payment. VA loans, If you belong to the military community, you may qualify for a loan insured by the Department of Veterans Affairs.

How To Finance A Mobile Or Manufactured Home Things To Know Before You Buy

Even if you don’t own the land on which your home will be located, you might be able to secure financing with a chattel loan. As a result, they are a popular loan option for buyers who plan to rent a lot in a manufactured home community. Some lenders offer chattel loans for manufactured home purchases that are insured by the Federal Housing Administration (FHA), the U.S.

If you found this post helpful, visit out main page for more mortgage information by clicking here.

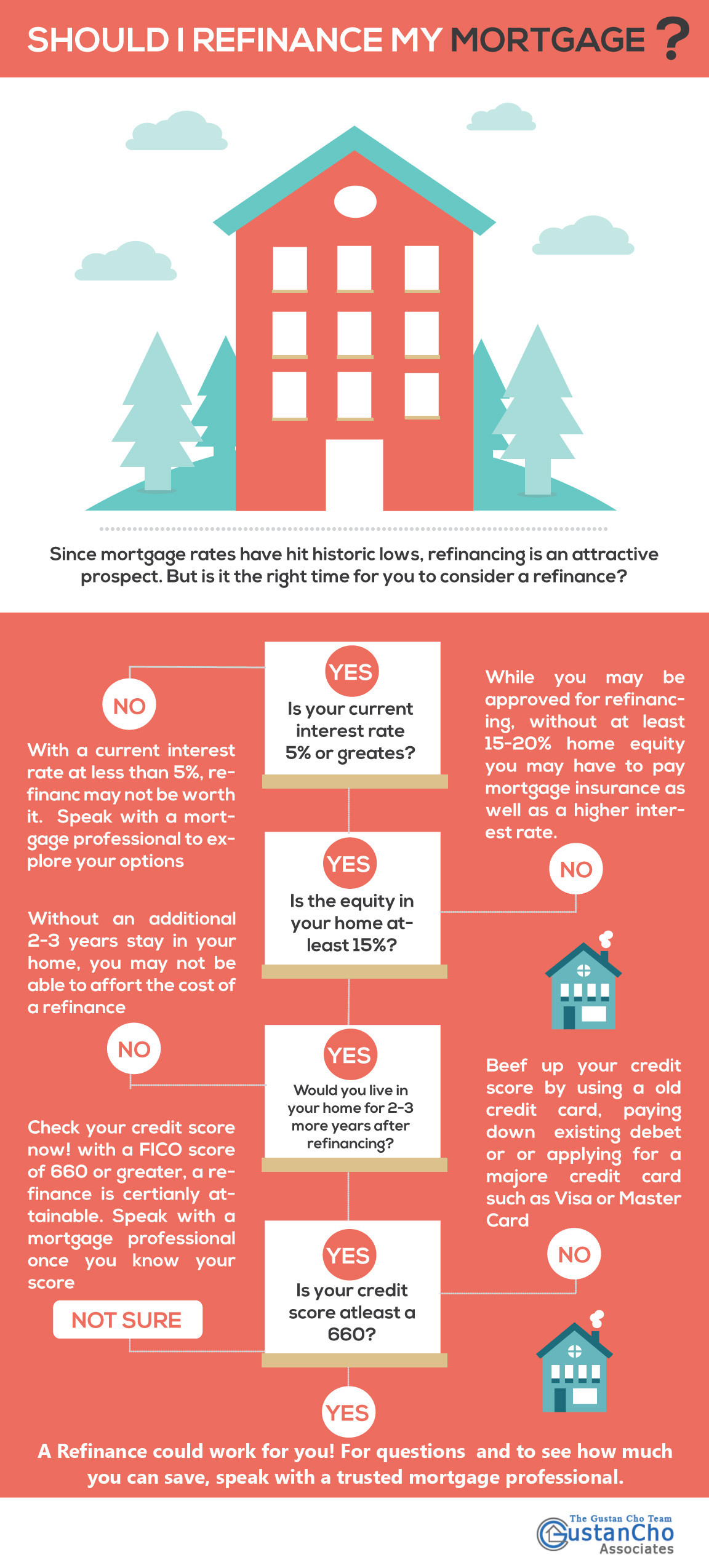

When Should I Refinance My Mortgage

When To Refinance A Mortgage: Is Now A Good Time? in Lowell-Massachusetts

Are you asking yourself, when should I refinance my mortgage? This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact Anna Palagi at [email protected].

But you’ll need to make sure the savings are large enough that you won’t lose money after paying the closing costs to refinance your mortgage. What Is a Mortgage Refinance? A mortgage refinance is the replacement of your existing mortgage with a new mortgage that has different terms. Usually, one of those terms is a lower interest rate.

When Should I Refinance My Mortgage? – Wecu in Thousand-Oaks-California

You have to calculate how much you’d save based on each lenders offer. But if the current rates are lower than your existing rate, it’s a good time to do the math and seek options. The typical homeowner who refinanced in 2020 lowered their rate by 1 – how much cost to refinance mortgage. 2 percentage points, according to Freddie Mac.

: When Is Refinancing a Bad Idea? It’s tempting to want to refinance when you see how low the current market rates are, and how many other people are doing it. When does it pay to refinance a mortgage? However, after considering your own circumstances, you might find that refinancing isn’t a good choice for you if one of these situations applies.

When Should You Refinance A Home? in Moreno-Valley-California

If you refinance into another 30-year loan, you’re putting yourself in a situation where you’re paying a mortgage for 35 years instead. Since you mostly pay interest during the first years of a 30-year loan, this type of refinancing can be costly in the long run even if it lowers your monthly payment in the short run – can’t refinance mortgage after divorce.

Just because you can do a cash-out refinance doesn’t mean you should. If your goal is to one day be mortgage-free, and if your cash-out refinance will not substantially improve your finances or your quality of life, you may just want to skip it. Most of the time, you will not be able to refinance if you’re unemployed.

Should I Refinance My Mortgage Now?- Nextadvisor With Time in Berkeley-California

However, you don’t have to stick with your current lender. You can and should shop around and get at least three quotes. It makes sense to go with the option that will save you the most money. Also, something that might be different since you last applied for a mortgage is that many lenders have moved more of their processes online.

In June, the average time to close on a refinance was 48 days, according to ICE Mortgage Technology. Interest Rates At some point in the refinancing process, you’ll need to lock your interest rate. Your lender should be able to tell you how long you can expect your loan to close based on the company’s current turn times.

Refinance Faqs – Residential Mortgage in Indianapolis-Indiana

If you plan on selling your home prior to the breakeven point, now may not be the time to refinance your mortgage. 3. How much can a lower interest rate save you? Don’t focus too much on how much interest rates have dropped. Instead, look at how much money you can save based on the rate change.

Depending on your loan term, taxes, and insurance, you could be looking at $200 in monthly savings. 4. How much equity do you have in your home? Always take equity into consideration when deciding to refinance your mortgage. The more equity you have, the better rates you can access. You can even avoid mortgage insurance.

Should I Refinance My Mortgage Calculator in Spokane-Valley-Washington

As an example, owing $100,000 on your mortgage with $50,000 available equity may allow for a new loan of $125,000. With a lower interest rate, your monthly payments may stay the same while you cash out the extra $25,000. Mortgage refinancing benefits Once you feel good about your responses to the above questions, let’s consider the benefits of refinancing.

It’s a great option if interest rates are lower than when you originally financed your home. It’s also useful if you have an adjustable-rate mortgage (ARM) that will soon have a higher interest rate, or if you have private mortgage insurance that can be removed. Build equity Homeowners can build equity faster if they’re in a financial position financially to make a higher than usual monthly payment (who do I refinance my mortgage with).

Should I Refinance My Mortgage – Nationwide in Spokane-Washington

Plus, you can save significantly on interest payments. Switch loan programs The loan you started with may not suit you later in life. The good news is: you have options! Maybe you want to take advantage of lower rates. Or, maybe your ARM’s fixed-rate period is about to expire. No matter what your need, you can trust there are a variety of loan programs that can be customized to fit your current stage of life.

While transitioning from a 30-year to a 15-year loan may boost your monthly payments, paying it off sooner saves significant interest over the life of the loan. Try our mortgage refinance calculator An easy way to see potential cost savings is to use a mortgage refinance calculator. You can adjust your interest rate or loan term to see how much you can save each month.

Is Now Still A Good Time To Refinance A Mortgage? in Westminster-Colorado

Now that you have an understanding of what’s involved and the potential benefits, you should ask yourself: is it time to refinance? There’s no right or wrong answer, of course, as it depends on each person’s financial situation. So take the next step and consult with American Financing. You can receive answers to any additional questions you may have.

Many customers are saving up to $1,000 a month. Why not see what we can do for you? There’s no obligation to move forward, and there are never any upfront fees. Schedule an online appointment with one of our experienced mortgage consultants, or give us a call for a free consultation! .

Should I Refinance The Mortgage On My House? in Cedar-Rapids-Iowa

You can also look at taking equity out of your home for debt consolidation. 4. Length Of Time You Plan To Stay In Your Home Not only do you need to wait a certain amount of time before you can take cash out if you just took over the title, but you also need to consider how long you want to stay in your home and whether refinancing will make sense. To refinance mortgage or not.

If you only plan on being in the home for 10 years, you’ll be able to get a lower rate with an ARM than you could have gotten with a fixed-rate mortgage and be ready to move before it ever adjusts. If you plan to own your home for 2 years or less, it’s likely not worth refinancing unless it’s to a much lower rate.

Does Refinancing Reset Your Loan Term? – Experian in Costa-Mesa-California

Calculate how fast you can become debt-free

Your Loan Term While there are exceptions if a financial change has made you want to drastically lower your payment, most people like to have a loan term that’s at least equal to the number of years they have remaining on their original mortgage if they can afford it – knowing when to refinance your mortgage. Many lenders only offer loans in set terms, but Quicken Loans are able to offer fixed-rate financing for conventional loans in terms anywhere between 8–29 years.

For more articles like this, click here.

Refinance Mortgage Benefits

Mortgage Refinances For Your Home in Provo-Utah

Mortgage refinancing can provide a number of benefits. These will vary from borrower to borrower, depending on what they’re looking to achieve. But a refinance will generally provide one or more of the following: A better mortgage rate This may be the most common reason for refinancing. If mortgage rates have fallen since you took out the loan, you can often save money by refinancing you mortgage into a new home loan at current rates.

Lower monthly payments With a lower interest rate, you can get lower monthly payments as well, particularly if your refinanced mortgage has the same payoff date as your old home loan. You can also lower your monthly mortgage payments by extending your payoff date past what it currently is, so you’re paying less in principle each month.

Refinance Mortgage Loan in Wilmington-North-Carolina

That way, you don’t have to worry about your monthly payments increasing if rates should rise. Shorten your term Many borrowers start out with a 30-year home loan, then refinance to a 15-year fixed-rate mortgage after a few years. This allows them to pay the mortgage off faster and save a lot of money in interest over the life of the loan.

Borrow money With a cash-out refinance, you can borrow against your home equity to obtain funds for any purpose. You receive a check at closing, the amount of which is added onto the mortgage principle you owe. Since mortgage rates tend to be lower than other types of debt and tax-deductible as well, it can be a very cost-efficient way to borrow.

When To Refinance Mortgage – Low Interest Rates in Inglewood-California

Mortgage rates are usually lower than the interest rates paid on credit cards and other unsecured debt, so you save on interest payments. Mortgages can also be repaid over longer terms than most other types of debt, up to 30 years, so you can reduce your monthly payments against debt principle, if that’s your goal (refinance mortgage benefits).

Couples can deduct the interest paid on up to $100,000 obtained through a cash-out refinance for debt consolidation; for single persons the limit is $50,000. Combine two mortgages into one You can also combine a second mortgage or HELOC (home equity line of credit) into a single primary mortgage at a lower rate.

The Pros And Cons Of Mortgage Refinance – The Balance in Roseville-California

The only way to get them off the mortgage is by refinancing. This can also be used to remove the name of a co-signer whose support is no longer necessary and wishes to be freed of liability – save on mortgage.

The biggest reason is to save money on their monthly payment. You can do this through a refinance by moving to a lower interest rate or by eliminating your private mortgage insurance (PMI) payment from the loan amount. Another reason to consider a mortgage refinance is to unlock some of the equity you have built into your home.

The Cost To Refinance A Mortgage in Akron-Ohio

Refinancing can also help you reduce the amount of time you will be paying your home loan. By shaving years off your mortgage, you can unlock more equity faster or walk away with more money if you decide to sell your home. If you are curious about how you could save money, a mortgage refinance calculator can help you compare the costs and benefits of refinancing.

Refinancing from a 6% interest rate to a 3% interest rate can put over $4,000 back in your pocket every year. Benefits of Refinancing Your Mortgage, There are numerous benefits to refinancing your mortgage – save on mortgage. While most of them revolve around reducing your monthly payment, a new mortgage can have a shorter term, stabilize your payment with a fixed interest rate or help you use the equity you have built up in your home.

Mortgage Refinance Options – Refinancing A Home – U.s. Bank in Macon-Georgia

For example: Refinancing a $250,000 mortgage to lower the interest rate from 6% to 3% would save over $400 per month on interest and principal payments alone. Purchasing your home with less than a 20% down payment means you will probably pay private mortgage insurance (PMI) on top of your principal and interest.

This means you will need to pay cash out of your pocket to lock in your loan. Some mortgages may have prepayment penalties, meaning you’ll pay more if you decide to reduce your balance early. Be sure to understand the terms and conditions before closing. Extending the life of your home mortgage by several years could put your break-even point further out in the future, depending on how long you intend to live in your home.

Reasons For Home Loan Refinancing – Midland Texas Morgage in Chicago-Illinois

1Set a Goal for Your Mortgage Refinance, Before starting toward refinancing, it’s important to set a goal for starting a new mortgage. Are you interested in saving money on your monthly payment? Or is taking out cash to consolidate debt or fund a big project more important? By setting a clear-cut goal, you can decide the best way to move forward with a refinance.

If you qualify for a VA mortgage refinance or FHA mortgage refinance, you will want to work with lenders who can help you explore those options. 4Select a Mortgage Refinance Lender and Lock Your Refinance Rate, Once you’re satisfied that you’ve found the best option, it’s time to “lock” your rate with the lender.

Mortgage Refinancing – Mission Federal Credit Union in Vallejo-California

Mortgage refinancing is a strategy that helps homeowners meet their goals (refi). This could mean refinancing to a lower interest rate or refinancing to a different mortgage term. Refinancing a home is a major financial decision and one that shouldn’t be made without doing all the research. When you refinance, your new lender pays off your old mortgage and replaces it with a new mortgage.

Finally, you can lock your rate in with your lender (refi). Make sure to have some cash to pay for things like closing costs, property taxes and other fees. Generally, when you buy a home you have to pay certain closing costs to complete the sale. When you refinance, you’re essentially replacing your original mortgage loan with a new one which means you have to pay closing costs again.

What Are The Benefits Of Refinancing Your Home Loan? in Laredo-Texas

There are no refunds if your application is denied. refi. If the appraisal isn’t included in the application fee, you can expect to pay a professional appraiser anywhere from $300 to $1,000 for their time. Assuming your application is approved, you’ll also have to pay a loan origvination fee. This fee covers the lender’s administrative and financing costs and it’s usually one percentage point of your refinance loan amount.

Some of the other costs you may have to pay include a title search fee, an inspection fee, flood certifications, recording fees and attorneys’ fees. These fees can easily increase the cost of a refinance by several hundred dollars or more. The number one reason that many people refinance is to get a lower interest rate on their mortgage.

Today’s Mortgage Refinance Rates – Citizens Bank in Santa-Clara-California

Adjustable rate loans can save you money in the short-term but they can be dangerous if your payment suddenly shoots up due to a rate change. The same is true if you’ve got a HELOC that’s approaching the end of its interest-only repayment period. Once you have to start repaying the principal, you could see your payments increase substantially which can put a major strain on your wallet.

How Much Will It Save

How Much Will Refinancing My Mortgage Save in Naperville-Illinois

For the latest information on how to cope with financial stress during this pandemic, see Nerd, Wallet’s financial guide to COVID-19. How does refinancing work? When you buy a home, you get a mortgage to pay for it. The money goes to the home seller. When refinancing a home, you get a new mortgage.

Mortgage refinancing requires you to qualify for the loan, just as you had to meet the lender’s requirements for the original mortgage. You file an application, go through the underwriting process and go to closing, as you did when you bought the home. Why and when you should refinance a home, Before you begin, consider why you want to refinance your home loan.

Reduce the monthly payment. When your goal is to pay less every month, you can refinance into a loan with a lower interest rate. Another way to reduce the monthly payment is to extend the loan term — say, from 15 years to 30. The drawback to extending the term is that you pay more interest in the long run.

When you refinance to borrow more than you owe on your current loan, the lender gives you a check for the difference. This is called a cash-out refinance. People often get a cash-out refinance and a lower interest rate at the same time. Pay off the loan faster. When you refinance from a 30-year mortgage into a 15-year loan, you pay off the loan in half the time.

How To Know If Refinancing Mortgage Is Worth It in McAllen-Texas

There are pros and cons to a 15-year mortgage. One downside is that the monthly payments usually go up. Get rid of FHA mortgage insurance. Private mortgage insurance on conventional home loans can be canceled, but the Federal Housing Administration mortgage insurance premium you pay on FHA loans cannot in many cases.

With Nerd, Wallet, you can easily track your home value and see if you can save by refinancing. Refinance into another 30-year home loan? Reducing your monthly payment is usually the goal. And it’s tempting to refinance with another full 30-year term to lower your mortgage payment. mortgage refinancing. But that means you’ll end up taking even longer to pay off your house and paying more interest over the long run.

For example, if you’ve had a 30-year loan for three years, you have 27 years remaining. You can tell the lender to set up the payments so you repay the refinanced loan over 27 years instead of 30. mortgage. This way, you reduce the interest you pay over the life of the loan.

Shop the best refinance rates, Now for a little legwork — or more likely web work and phone calls. You want to shop for your best refinance rate and get a Loan Estimate from each lender. Each potential lender is required to issue the estimate within three days of receiving your basic information.

How Mortgage Refinancing Works in Lakewood-Colorado

Compare the loan details from each lender and decide which one is best for you. This is a good time to work that mortgage refinance calculator. Compare mortgage refinance lenders, Refinancing a mortgage, step by step, Ready to tackle the refinance process? Go! Set your goal. Reduce monthly payments? Shorten the loan term? Get rid of FHA mortgage insurance?Apply for a mortgage with three to five lenders.

Closing on a refinance is like closing on a purchase loan, with one main difference: No one hands you the keys to the home at the end..

The refinancing process is often less complicated than the home buying process, although it includes many of the same steps. It can be hard to predict how long your refinance will take, but the typical timeline is 30 – 45 days. Let’s take a closer look at the refinancing process.

It’s also a good idea to have your tax returns for the last couple of years handy. You don’t have to refinance with your current lender. If you choose a different lender, that new lender pays off your current loan, ending your relationship with your old lender. Don’t be afraid to shop around and compare each lender’s current rates, availability and client satisfaction scores – mortgage refinancing.

Will Refinancing My Mortgage Hurt My Credit in Chico-California

In some cases, you might be able to get the best of both worlds with a float-down option, but if you’re happy with rates at the time you’re applying, then it’s generally a good idea to go ahead and lock your rate. Underwriting Once you submit your application, your lender begins the underwriting process.

Your lender will verify the details of the property, like when you bought your home. This includes an appraisal to determine the home’s value – refinancing. The refinance appraisal is a crucial part of the process because it determines what options are available to you. If you’re refinancing to take cash out, for example, then the value of your home determines how much cash you can get.

Home Appraisal Just like when you bought your home, you must get an appraisal before you refinance. Your lender orders the appraisal, the appraiser visits your property and you receive an estimate of your home’s value – mortgage refi. To prepare for the appraisal, you’ll want to make sure your home looks its best.

Alternatively, you can do what’s called a cash-in refinance and bring cash to the table in order to get the terms under your current deal. Closing On Your New Loan Once underwriting and home appraisal are complete, it’s time to close your loan. A few days before closing, your lender will send you a document called a Closing Disclosure.

Will Refinancing My Mortgage Hurt My Credit in Carmel-Indiana

The closing for a refinance is faster than the closing for a home purchase. The closing is attended by the people on the loan and title, and a representative from the lender or title company. At closing, you’ll go over the details of the loan and sign your loan documents.

Extra Mortgage Payment Principles

Should You Make Extra Mortgage Principal Payments? in Carrollton-Texas

On the flip side, you could go for another 30-year term to reduce your regular monthly payments. Nevertheless, loans with shorter terms tend to have lower interest rates, allowing you to both save on interest and reach full ownership much earlier. In some cases, however, refinancing could cost you more in the long run, particularly if you’re planning to extend your loan term.

Do not forget closing costs either. If your lending institution consents to let you roll those expenses into your loan, you could wind up paying more cash. After all, you’ll now be on the hook for interest on a larger loan quantity. Whether you need to settle your mortgage early ultimately depends upon just how much money you have to spare, what your options are, and other elements that are distinct to you.

If you’re ready to discover an advisor who can assist you achieve your monetary goals, start now. Securing a home mortgage can be a stressful and confusing procedure. For starters, you require to find out what term is best for you, whether you want a repaired or variable rate of interest, and where to get the best mortgage rates.

Mortgage Early Pay Off Calculator – Free & Easy To Use in Lowell-Massachusetts

How do I pay off my mortgage early? One method to settle your home loan early is by including an extra amount to your regular monthly payments. eLearning Course How Money Works””>Payoff Mortgage Fast. However, just how much more should you pay? Nerd, Wallet’s early home loan reward calculator figures it out for you (pay off mortgage 10 years). Complete the blanks with information about your home mortgage, then get in the number of more years you want to pay it.

What the early home mortgage payoff calculator does, Do you want to settle your home loan early? Possibly you have 27 years staying on your home mortgage but you would rather pay it off in 18 years instead. The early reward calculator shows how to reach your objective. The mortgage reward calculator reveals you: How much more primary you would need to pay each month so you can pay off the loan in a specific number of years.

There are lots of factors you may desire to accelerate the home mortgage’s payoff, however, the inspiration normally comes down to either or both of these: You desire to own your house free and clear by a turning point in life, such as your retirement or the beginning or end of your kids’ college years.

Should You Pay Off Your Mortgage Early? – Money Helper in Lakewood-Colorado

How to use the early mortgage payoff calculator To complete the calculator’s boxes properly, seek advice from a current monthly statement or the very first page of the Closing Disclosure that you received when you closed on your home loan. Under Loan term (in years), go into the variety of years for which your house is financed.

Under Interest rate, get in the percentage. Under How many years are left on your home mortgage? Under In how many years do you want to pay off your home loan?

Or you can utilize Nerd, Wallet’s mortgage amortization calculator and drag the slider to find out just how much you still owe. What the mortgage benefit calculator tells you, The Summary Results section has two subheadings: How to reach your objective describes how much you would have to pay in primary and interest each month to satisfy the payoff goal.

When Should You Pay Off Your Mortgage Early? – The Motley … in Honolulu-Hawaii

Loan comparison summary explains the total cost of the home loan in principal and interest payments, the original regular monthly principal-and-interest payment, the total expense in principal and interest if you pay it off early, and the new month-to-month principal-and-interest payment to reach your reward objective.” New month-to-month P&I” and “Original month-to-month P&I” comprise only the principal and interest parts of your month-to-month payments.

If you can refinance to a lower interest rate, for a much shorter term, it’s a win-win. For example, you could re-finance a 30-year home mortgage into a 15-year loan. The month-to-month payments will likely be greater, and you’ll pay closing costs, however, your total interest cost will be significantly lower.

Want to pay off your home loan quicker than 30 years? There are numerous good ways to pay off your mortgage faster and save big on interest payments (eLearning Course How Money Works””>Payoff Mortgage Fast).

Should I Pay Off My Mortgage Early? – The Washington Post in Lowell-Massachusetts

If you have additional money to spend on your mortgage, it might generate more worth elsewhere. Few individuals keep a 30-year loan for its full term.

But what about property owners who sit tight for the long run? Those thirty years of interest payments can start to feel like a concern, especially compared to the payments on today’s lower interest rate loans. You might find yourself questioning how to pay your home loan off faster so you can live debt-free and have full ownership of your home.

There are a number of ways to reduce your loan term and save a ton of money in interest on your home loan. Refinance to a shorter term The 30-year house loan is most popular, but loan providers offer much shorter loan terms, too.

Pitfalls Of Paying Off Your Mortgage Early – Abc News in Roseville-California

625%, your regular monthly payment would be $1,450 You’d pay a few hundred more per month, however, you would be mortgage-free a decade faster The very best part? The savings in interest on that 20-year mortgage would be over $65,000 if you kept the loan till it was paid off. Another benefit of refinancing to a shorter-term is that you do not have to start over with 30 more years. Pay off mortgage faster calculator.